Get Your Free Financial Worksheets

Transform your financial habits with our action-packed worksheets! Designed to complement the Financial Mastery eBook, these worksheets help you track your progress, build habits, and take control of your finances—one step at a time.

Your email is safe with us. No spam, ever.

Transform Your Life

About The Book

This 10-week program guides you to financial mastery through simple, actionable steps. Whether you're struggling with debt, living paycheck-to-paycheck, or ready to grow your savings, this book is for you.

Each week focuses on a specific aspect of personal finance, breaking it down into manageable daily challenges. With tools, worksheets, and practical tips, you’ll gain confidence in managing your money and building wealth.

What's inside?

Preview at a Glance

Introduction

Are you barely making ends meet?

Do you find yourself anxiously counting the days until your next paycheck?

Is the thought of managing your finances overwhelming, leaving you stuck in a cycle of stress and uncertainty?

If so, you’re not alone—and this program is designed specifically for you.

“Financial freedom is not a dream; it's a result of small, consistent actions.”

Personal finance touches every aspect of our lives, from the choices we make today to the dreams we hope to achieve tomorrow.

Yet, too many of us struggle in silence, unsure of how to break free from the paycheck-to-paycheck grind.

The good news?

You don’t need to be a financial expert to take control of your money.

All you need is the willingness to take small, consistent actions.

“A journey of a thousand miles begins with a single step.” – Lao Tzu

This program is your step-by-step guide to transforming your financial future.

Whether you’re drowning in debt, struggling to save, or simply looking for a clearer path to financial security, this journey will provide the tools and strategies you need.

Getting Out of Debt

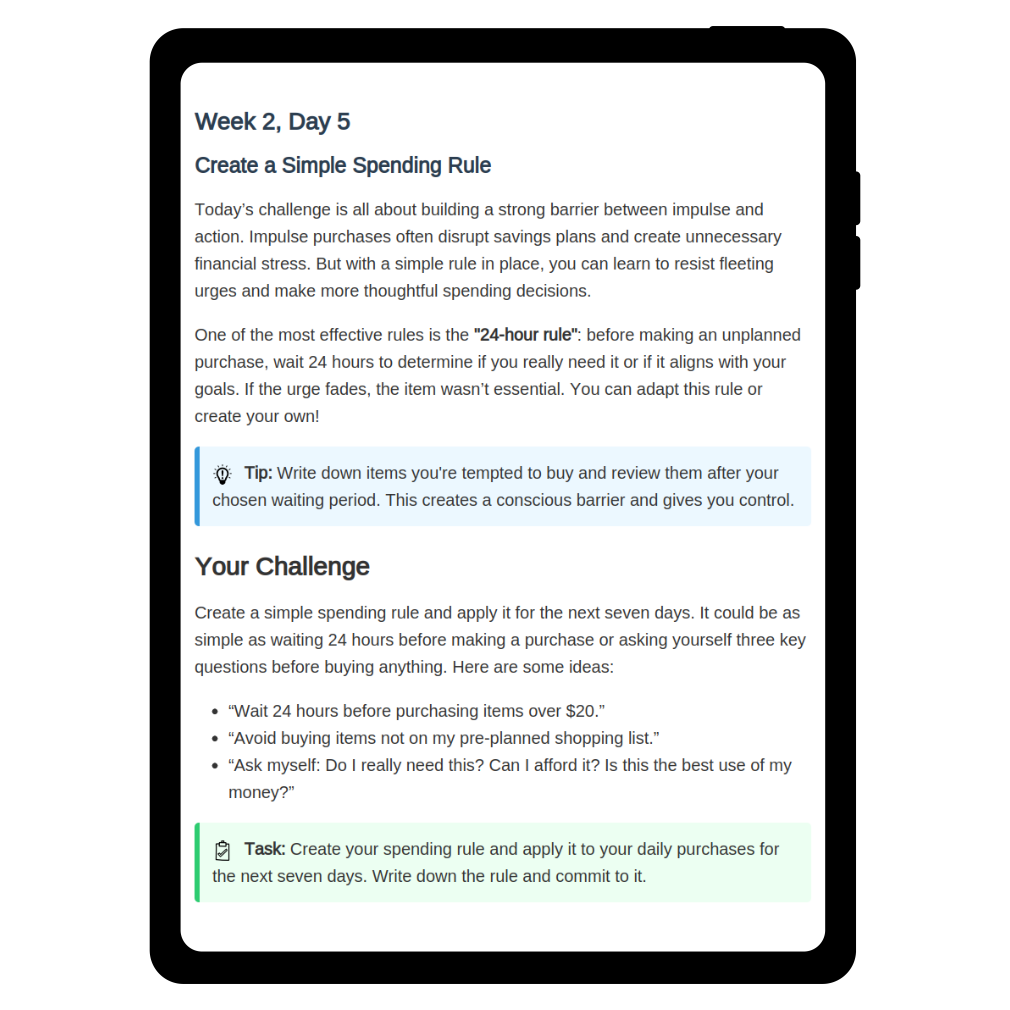

Weeks 1 to 3 are all about building a strong foundation and tackling debt.

“Debt is like any other trap; easy enough to get into, but hard enough to get out of.” – Josh Billings

You’ll begin by gaining a clear picture of your financial habits, learning how to track your income and expenses, and identifying unnecessary spending.

Next, you’ll create a realistic budget, explore practical ways to save, and take your first steps toward eliminating debt.

Finally, we’ll focus on boosting your income with simple strategies, such as selling unused items, freelancing, or leveraging your existing skills.

Creating Sustainable Finances

Weeks 4 to 6 focus on building financial resilience and sustainable habits.

“Sustainability isn’t just about saving the planet; it’s about saving your finances too.”

You’ll establish an emergency fund, automate savings, and implement strategies to safeguard your finances.

Strengthening these habits will provide you with the tools to stay on track even when life throws unexpected challenges your way.

Creating Wealth

In Weeks 7 to 9, we shift our focus to long-term goals and wealth-building strategies.

“Wealth is the ability to fully experience life.” – Henry David Thoreau

You’ll learn to budget effectively for future aspirations, fine-tune your financial allocations, and explore investment opportunities.

With clear goals and a strategic plan, you’ll take actionable steps toward growing your wealth and achieving financial independence.

Build Momentum and What’s Next?

Week 10 is all about maintaining the momentum you’ve built and setting the stage for long-term success.

“Success is the sum of small efforts, repeated day in and day out.” – Robert Collier

You’ll reflect on your progress, solidify your financial habits, and outline the next steps in your journey.

This final section serves as a launchpad, helping you stay motivated and consistent as you continue to grow.

Reviews

What Readers Are Saying...

"This book made financial planning easy and actionable. I've already seen improvements in my savings habits!"

"A game-changer! The 10-week structure kept me accountable and motivated."

Contact

Get in Touch

If you have any questions about the eBook or want to share your success story, we’d love to hear from you!